Mexico Semiconductor Packaging Market Analysis by Size, Trends, & Research Report, 2033| UnivDatos

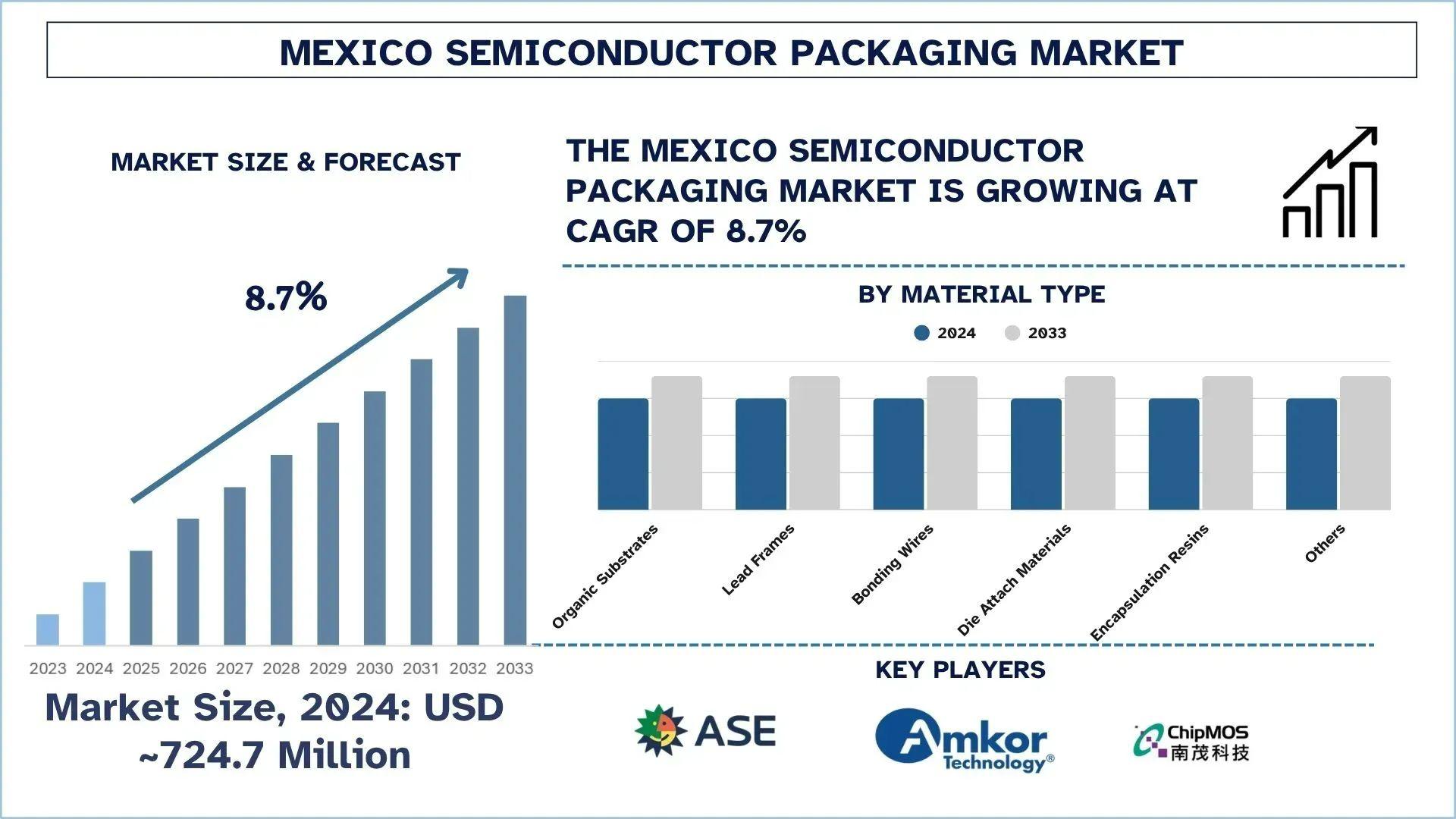

According to the UnivDatos, rising demand for automotive electronics, increasing adoption of advanced packaging technologies, and nearshoring-driven OSAT investments would drive the Mexico Semiconductor Packaging market. As per their “Mexico Semiconductor Packaging Market” report, the market was valued at USD 724.7 Million in 2024, growing at a CAGR of about 8.7% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

Momentum in the Mexican semiconductor packaging market is moving due to the rapid pace of the automotive electronics, consumer devices, and industrial automation. Semiconductor packaging that entails the process of wrapping up semiconductor components to guard them and also connect them electrically is being advanced amidst the rising demands of the packaging of compact, thermally efficient, and high-performance components. Flip chip, wafer-level packaging, and system-in-package (SiP) technologies are becoming popular and have been facilitated by the geographical positioning, talented labor force, and enhanced interconnection with the U.S.-based semiconductor supplies. A number of these companies, such as Foxconn, Pegatron, Wistron, Quanta, Compal, and Inventec, already own semiconductor manufacturing plants in northern Mexico. Tijuana and Juarez cities are the popular locations, and there are some places in Chihuahua, Nuevo Leon, and Sonora.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/mexico-semiconductor-packaging-market?popup=report-enquiry

The Growing Demand for Mexico Semiconductor Packaging

Mexico is increasing its presence in the world in terms of supplying electronics, as well as the automotive sector, and the rising needs of the semiconductor packaging market in Mexico may be very well attributed to the growth in this supply chain. With the increase in the electrification of vehicles, ADAS technologies, and in-vehicle connectivity, the demand for advanced, thermally efficient compact packages has shot up. At the same time, increased emphasis on consumer electronics, 5G infrastructure, and the use of IoT technologies are forcing manufacturers to exploit high-density packaging technologies (flip chip, fan-out wafer-level packaging, and system-in-package) as well. This demand is also being fast-tracked by Mexico. Mexico is uniquely positioned in proximity to the U.S. market and nearshoring, and the growth of local domestic semiconductor infrastructure, such as OSAT fabs and design centers. This is causing worldwide packaging firms and local stakeholders to spend fortunes in attaining the demands of a fast-adapting a digitized, and electrified economy.

Latest Trends in the Mexico Semiconductor Packaging Market

The Mexico Semiconductor Packaging market is witnessing several emerging trends. Here are some of the key trends shaping the market:

Rise of Advanced Packaging Technologies

High interest in high-end packaging technologies (i.e., flip chip, system-in-package (SiP), and fan-out wafer-level packaging) is being experienced in Mexico. The formats are highly favorable in size, heat, and power boosting, and therefore suited to use in electric cars/trucks, 5G, and high-end consumer appliances. With the shrinkage in product design as well as the integration of functions, the need for such forms of packaging is steeply growing. Firms have been reacting by engaging in research and development and setting up local units with the capacity to undertake these elaborate procedures.

Fan-Out Packaging Gains Momentum

FO-out is rapidly being adopted in Mexico, as they are already supporting thinner profiles and higher I/O, and these Fan-Out Packaging can be done without the costly substrates. This trend is strongly noticeable in such segments as mobile devices, automotive sensors, and RF modules, where performance and space are imperative. Its cost effectiveness, enhanced electrical performance, and providing further demands among OEMs serving the global markets, as represented by Mexico, is also encouraging the use of fan-out packaging.

Automotive & 5G Fueling Demand

Automobile electronics, in particular, electric vehicles and autonomous technology, and 5G wireless infrastructure, are triggering a healthy demand for advanced semiconductor packages. In these areas, thermal reliability is high, signal speed and optimisation of space, all of which are answered using new packaging formats. With Mexico reinforcing its automobile manufacturing industry and as well as its connective infrastructure, these two verticals are turning out to be essential dynamics of growth in the packaging market.

Mexico Hub of semiconductor packaging: Jalisco Region

A blend of factors, including skilled workforce, solid industrial infrastructure, and rich North American markets, has caused Jalisco to spring up as a hub of semiconductor packaging in Mexico. The area, centred on Guadalajara, is a vibrant electronics manufacturing cluster, known as the Mexican Silicon Valley. With favorable home policies, university-industry alliances, and a strong ecosystem of supply chains, the state has been able to attract significant investments by international OSAT companies and equipment providers to the semiconductor industry. Advanced packaging and testing are among the main areas of concentration in Jalisco and have led it to become one of the pillars of Mexico's becoming part of the international semiconductor value chain.

Click here to view the Report Description & TOC https://univdatos.com/reports/mexico-semiconductor-packaging-market

Packaging Mexico’s Future in Silicon

The market packaging semiconductors in Mexico is also in the transition period as it has a flourishing industry of automotive electronics, an increase in nearshoring services, and deployment of the latest packaging technology. The demand in the market has been skyrocketing towards compact semiconductor solutions that perform well and are rugged, and it is therefore quite likely that the nation can play a critical role in the North American semiconductor supply chain. Even such strategic poles as Jalisco are already leading, welcoming the other global players and flying the innovators. As an investment, good policy instruments and partnership in the field go, one will find Mexico as a centre in the fourth generation of global packaging and assembly of the semiconductor.

Related Report:-

India Semiconductor Market: Current Analysis and Forecast (2024-2032)

EV Semiconductor Market: Current Analysis and Forecast (2022-2030)

Electric Vehicle Semiconductor Market: Current Analysis and Forecast (2021-2027)

AI in Manufacturing Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/