India Condom Market Growth, Size, Share and Forecast to 2033

In a country that still carries social stigma on talking openly about sexual wellness, India’s condom market is witnessing a change. Brands are busy rewriting the narrative around protection, pleasure, and responsibility, from hushed pharmacy transactions to bold digital campaigns. Mumbai's urban youth and, by extension, India's youth, have never been more digitally connected, social, and health conscious, and this evolution can be extended with that broader cultural shift affecting urban communities.

Consumer Perceptions on Alteration

In India, it was the tradition to buy condoms only with embarrassment and secrecy. Condom advertisements were few and, for the most part, strictly limited to late-night television relaying innuendo and offending metaphors. As the awareness for sexual health, population control, and prevention against STIs rises, especially among the urban millennials and Gen Z generations, the brands are now trying to normalize condom use into a safe lifestyle by removing the taboo from it.

Namely, more than 65% of India’s population is under the age of 35, which means they expect a product to be relatable, innovative, and open; the messaging of a product must be similar. More couples are choosing to use family planning options, and conversations about consent and pleasure are gaining traction.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-condom-market?popup=report-enquiry

Inclusive and Bold Branding Strategies

Currently, major Indian players, namely, Manforce (makes Mankind Pharma), Skore (TTK Healthcare), and Durex (Reckitt Benckiser), are the pacesetters, with rebranding efforts. The traditional male-centric narratives are being left behind by these companies that are instead crafting campaigns that focus on consent, sex empowerment, and sexual freedom. Take Durex as an example, whose marketing tends to feature women in lead roles to emphasize that safe sex is everyone’s responsibility.

On top of that, even a large number of brands that have been using old-fashioned packaging for their products have started using sleek, minimalistic designs like lifestyle or luxury products. Now, bright colors, bold typefaces, and quirky taglines can be found on the packaging of condoms, all intended to encourage consumers to feel assured when buying condoms offline or online.

Influencer and Digital Marketing are on the Rise.

Indian condom brands have adopted digital-first strategies due to the proliferation of smartphones and social media, as it allows them to reach younger audiences. But to spark a recent conversation about intimacy, relationships, and explicit consent—subjects that have been deemed political no no’s—people are taking to Instagram, YouTube, and Twitter.

Now, influencers and content creators are also roped into making interesting, witty, and educational videos. It is not merely advertisements but content, with a purpose, which are carved into broader lifestyle narratives—something that Skore’s ‘Climax Delay’ videos or Manforce’s wellness guides are. Alongside, collaborate with sexual wellness educators and health influencers to debunk myths and advocate for safe sex.

For the Tier II and III Markets

Metros such as Delhi, Mumbai, and Bengaluru are undoubtedly at the forefront of these branding shifts, but at the same time, companies are looking to semi-urban and rural areas, where condom taboos still prevail. This strategy involves affordable pricing, campaigning in regional languages, and collaborations with local health workers. For example, Manforce has concentrated much energy on the North Indian markets, focusing only on vernacular advertising and regional supply chains.

Poor schools are in these areas. With government campaigns and as a component of family planning, women’s health, and using condoms as essential prevention against STIs, brands are partnering with NGOs. Where resistance to such innovations continues to be high, a dual approach (commercial and educational) is slowly gaining a grip.

Growing Beyond One Product

The Indian condom brands, too, have innovated in terms of the variety of products on offer. Companies are offering flavors from chocolate to bubblegum, the dotted, ultra-thin thin or long-lasting type. Adding excitement through this product differentiation is also a great motivator for users to try and engage with the product, particularly users who aren’t familiar with it.

Some brands are turning sexual wellness kits containing lubricants, wipes, and more to promote themselves as more than condom manufacturers, but as holistic wellness brands.

Synergy of Social Campaign and Government

Condom brands are promoted in a supportive ecosystem as a result of India’s active promotion of family planning and sexual awareness initiatives, such as the National AIDS Control Programme (NACP) and Mission Parivar Vikas by the Indian government. Public policy that is seen as consistent with commercial branding has particularly high potential for reaching and creating credibility.

Availability of branded condoms in government hospitals and clinics is part of efforts to bridge the accessibility gap using public-private partnerships and strengthening social acceptability.

Related Reports:

Sexual Wellness Market: Current Analysis and Forecast (2025-2033)

Sex Toys Market: Current Analysis and Forecast (2025-2033)

Contraceptive Pills Market: Current Analysis and Forecast (2022-2028)

Contraceptive Drugs and Devices Market: Current Analysis and Forecast (2021-2027)

Inside India’s Condom Market: Awareness, Innovation, and Changing Mindsets

The Indian condom brands are not only selling a product, but also selling a conducive mindset. With this, these brands are engaging in efforts to shift the conversation from stigma to self-care and, in turn, help build the new narrative around intimacy in India. Rebranding of condoms is very instrumental as the country embraces digital media as a means for sexual health awareness and women's empowerment.

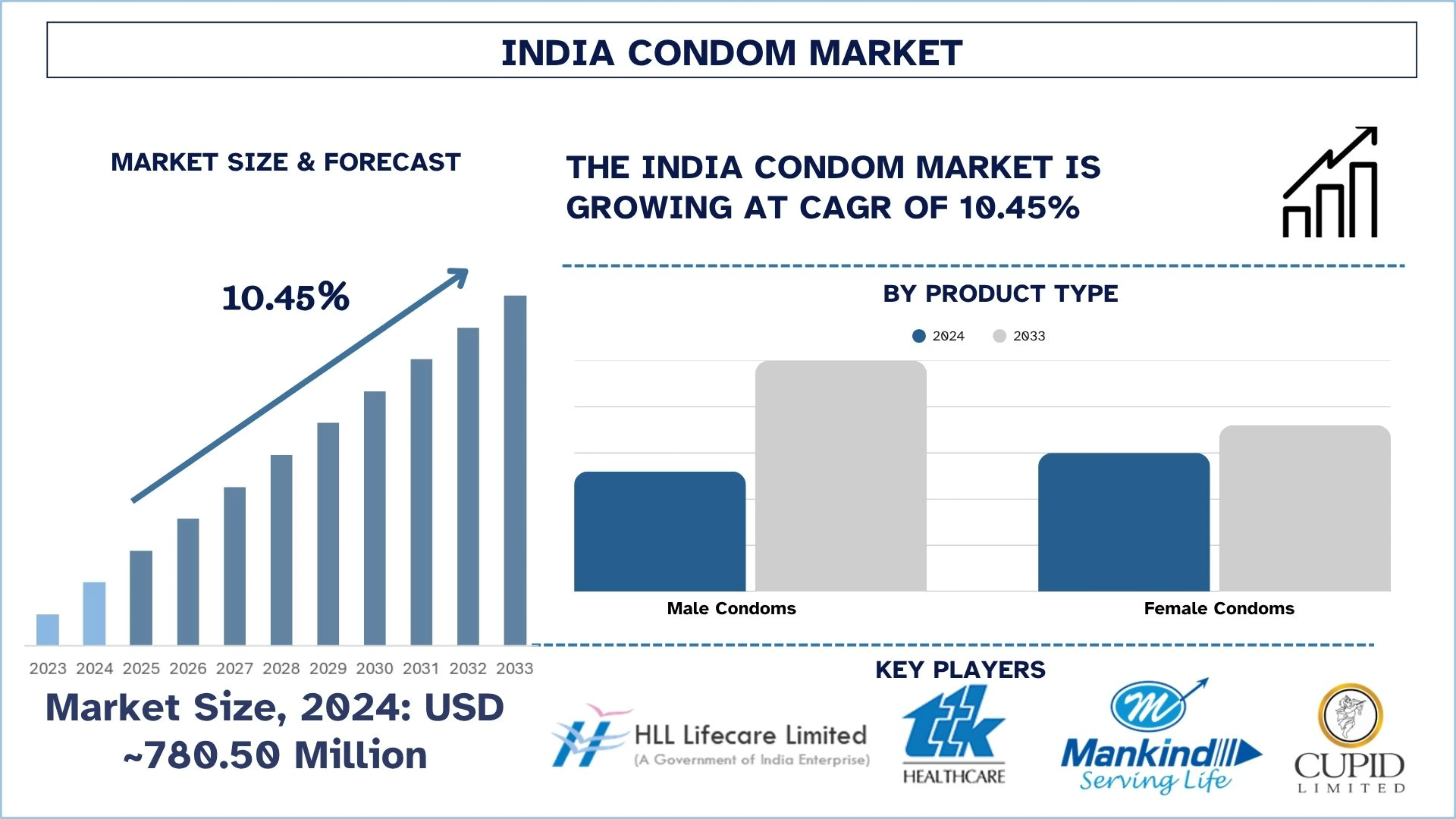

Never easy, breaking taboos is a challenge when backed with bold marketing, cultural sensitivity, and product innovation, and India’s condom market is setting an example for how sexual wellness can be responsibly mainstreamed. According to the UnivDatos, rising awareness of STIs and reproductive health, government-led distribution programs under NACO and NHM, increased urban youth population, and growing online retail channels promoting discreet and easy access to condoms is driving the India Condom market. As per their “India Condom Market” report, the Indian market was valued at USD ~780.5 million in 2024, growing at a CAGR of about 10.45% during the forecast period from 2025 - 2033 to reach USD million by 2033.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com