Japan Car Insurance Market Analysis by Size, Growth, & Research Report, 2033| UnivDatos

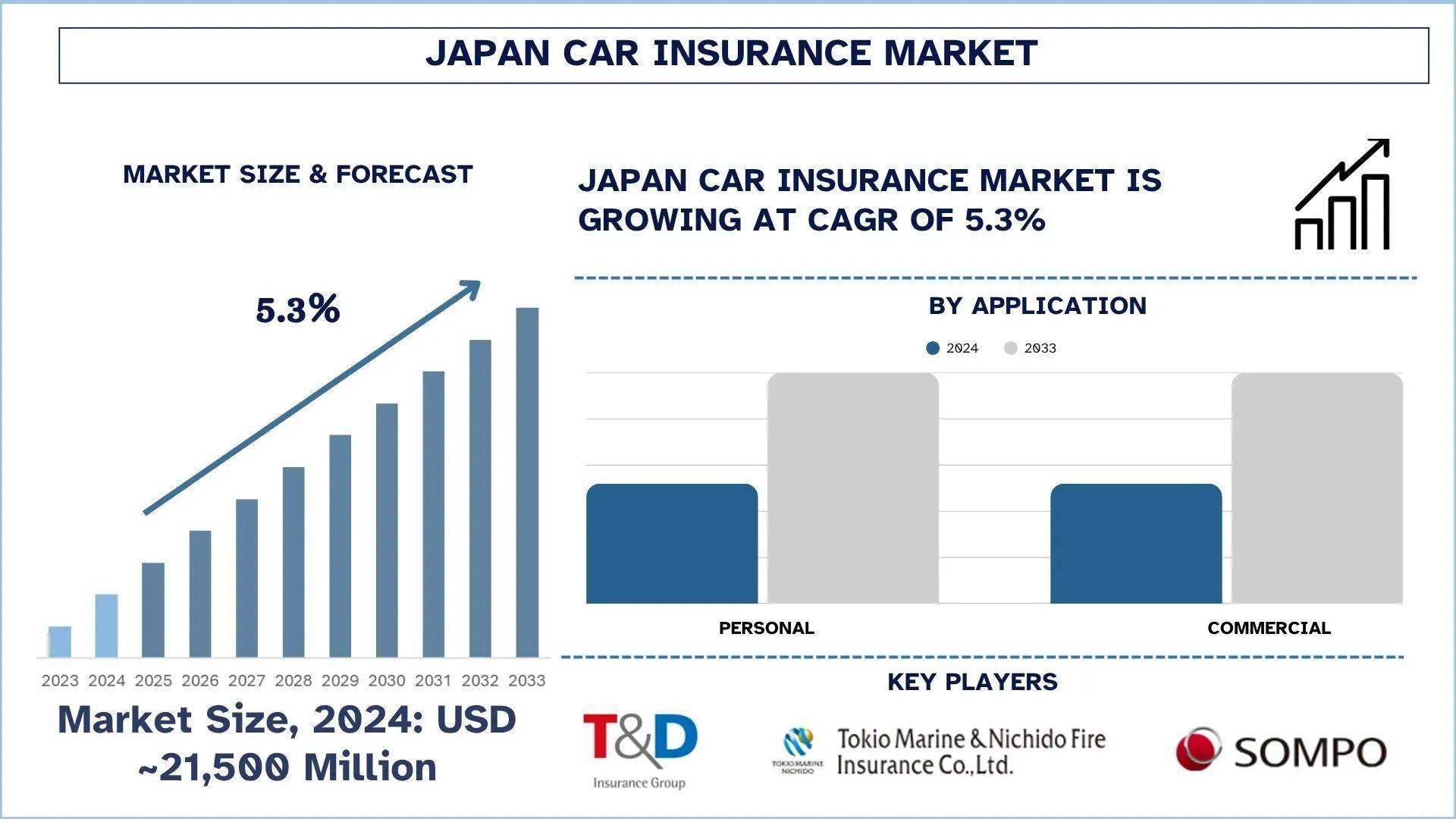

According to the UnivDatos, the integration of digital solutions, as well as the rising number of cars in Japan, would fuel the demand for Japanese Car Insurance. As per their “Japan Car Insurance Market” report, the Japanese market was valued at USD 21,500 million in 2024, growing at a CAGR of about 5.3% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The car insurance companies in Japan are undergoing a shift due to the integration of digital technologies and telematics. Companies are extensively investing in technologies to provide comprehensive solutions to their customers. Additionally, the country experiences a notable number of traffic accidents each year, prompting companies to compete for better solutions that not only reduce the likelihood of fraud but also provide timely reimbursement to customers in need.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/japan-car-insurance-market?popup=report-enquiry

Rising Traffic Accidents:

The traffic accidents in Japan are on the verge of rising as the number of cars in the densely populated region has grown extensively. Additionally, the aging population of Japan has further exacerbated the scenario, as many elderly customers find it difficult to navigate heavy traffic conditions, leading to an untoward situation. In recent years, the traffic accidents has notably grown in Japan. For instance, according to Nippon.com, the traffic accidents in 2023 rose to 307,911, an uptick of 7,072 from the year 2022.

Latest Trends in the Japanese Car Insurance Market

Digital Transformation and Telematics:

Car insurance in Japan is rapidly becoming a modernized sector through the application of digital transformation, with telematics at its center. Telematics refers to the use of in-car systems or the addition of devices to track driving in real-time, including vehicle speed, acceleration, braking, and distance traveled. With this kind of information, insurers are able to offer usage-based insurance (UBI) where the insurance premium is dependent on the driving behavior of the individual rather than the general measure of impending risk.

Telematics serves the purpose of encouraging safer driving habits in Japanese Motorists and to slash down the number of accidents, and motorists involved have continued to embrace the adoption of telematics by Japanese insurance companies. Firms give smartphone-based applications and dashboard-based hardware to monitor and display driving behavior in order to reduce the risk of policyholders driving carelessly.

Key Investment Trends:

With the rising demand for newer technology integration, as well as the timely reimbursement to the insurers, the companies in Japan are profoundly investing in newer technologies. Additionally, with the fast pace of shift in the insurance sectors across the globe, the Japanese companies are focusing more on digital transformation, telematics, as well as on usage-based insurance for the customers. In line with this, the insurance companies have gained better prominence in terms of investing in and acquiring various digital solutions providers. For instance, in 2025, Coalition, an active insurance services provider, announced that it had received USD 30 million from Mitsui Sumitomo Insurance Co., Ltd. (MSI), a member of MS&AD Insurance Group (MS&AD). This deal will be crucial for the insurance provider to actively participate in more markets as well as gain strategic independence through the integration of digital technologies in the long term.

Regional Market Growth

The Kanto region is one of the most developed car insurance markets in Japan. A high vehicle density in conjunction with tech-savvy consumers is leading to quick adaptation of digital tools by the insurers who are trying to streamline services. Policy administration with the help of an app-based system, and risk assessment being AI-driven, transforming customer expectations and enhancing the real-time experience of driving. It is increasingly being covered by the options that ensure electric and low-emission vehicles, as the region transitions to being sustainable. With lifestyles of customers changing to be convenient and mobile, insurance providers in Kanto are focusing on the flexibility of their plans, speed of claims, and personalized service to help keep them relevant in a highly competitive and transformative environment.

Click here to view the Report Description & TOC https://univdatos.com/reports/japan-car-insurance-market

“Tech-Backed Trust in Insurance to Promote Japan Car Insurance”:

The future of car insurance in Japan is shifting into a technology-dominated era as companies actively innovate and take measures to address the increasing rate of accidents. Customer engagement is evolving through telematics, digital platforms, and regional strategies, such as the Kanto strategy. Due to the increase in difficulties, the adoption of digital technologies in the sector is indicative of a more intelligent, safer way forward.

Related Report:-

Private Pension Insurance Market: Current Analysis and Forecast (2025-2033)

Dental Insurance Market: Current Analysis and Forecast (2025-2033)

Mexico Private Equity Market: Current Analysis and Forecast (2025-2033)

Insurance Rating Platform Market: Current Analysis and Forecast (2024-2032)

Insurtech Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/